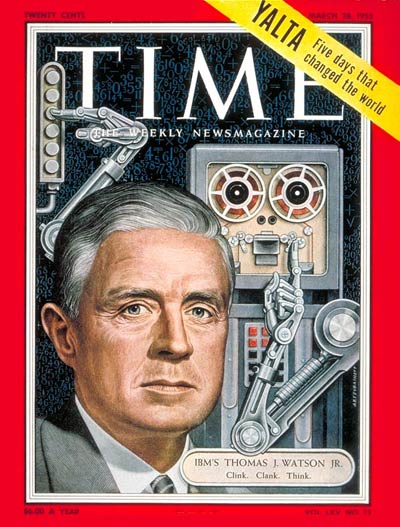

Time to ring the Bell. With the iPhone 4S, Apple has just surpassed the 70% gross margin metric that usually equates to a compute platform becoming an industry standard. IBM’s mainframe achieved it in the 1960s with the 360 series and still is able to crank it out with their Z-series. The combined Intel and Microsoft tandem (Wintel) achieved 70% in the late 1980s and continues to do so across even low-end PCs today. In addition, Intel generates >80% gross margins on its data center, XEON based platforms. Crossing 70% as one can see is a big deal and usually means that a standard has been created that cannot be overcome in head-to-head competition but only by a succeeding platform.

Time to ring the Bell. With the iPhone 4S, Apple has just surpassed the 70% gross margin metric that usually equates to a compute platform becoming an industry standard. IBM’s mainframe achieved it in the 1960s with the 360 series and still is able to crank it out with their Z-series. The combined Intel and Microsoft tandem (Wintel) achieved 70% in the late 1980s and continues to do so across even low-end PCs today. In addition, Intel generates >80% gross margins on its data center, XEON based platforms. Crossing 70% as one can see is a big deal and usually means that a standard has been created that cannot be overcome in head-to-head competition but only by a succeeding platform.

Prior to the iPhone, no one thought it was possible to build a highly profitable ecosystem in the phone business. A common theme expressed by writers such as John Dvorak just prior to the release of the first iPhone (see Apple should pull the plug on the iPhone). Back in 2007 Nokia, the leading phone manufacturer was registering just over 36% in Gross Margins. Not enough of a barrier to keep others out. Apple was entering a highly fractured, but relatively low margin market.

Apple’s 70% margin model was recognized by Analyst Chris Whitmore of Deutsche Bank (see Apple expected to achieve manufacturing margins of 70% with iPhone 4S). With Apple at only 5% of the overall phone market, this can be viewed as similar to IBM in the 1960s before the big mainframe ramp or Wintel in the late 1980s after the 386 started ramping. IBM’s mainframe revenue continued to grow through the 1980s, outlasting the minicomputer rage (DEC peaked just before the crash in 1987) but finally falling with the rise of the PC. Today IBM’s mainframe revenues are around $3.5B per year.

The question on everyone’s mind is how Intel and Microsoft’s revenue will fare in the coming years. IBM’s corporate revenue peak with its mainframe ecosystem occurred in 1990 at $69B. Roughly 3 years after DEC peaked with the VAX. From 1991-1993 IBM went into a deep three-year slide of unprofitability. Lou Gerstner was then hired in April of 1993 but with low hopes of stopping the bleeding.

It is significant to note that IBM’s slide started 9 years after the PC was introduced and perhaps more importantly 16 months prior to the launch of Window’s 3.1, which really marked the completion of the PC with the Full GUI Ecosystem (Including MSFT Office Apps). Intel was just starting to ramp in high volume its 2[SUP]nd[/SUP] generation 32-bit processor, the 486.

If the iPhone is the new compute platform going forward, then from the above analysis, what we should expect is that the Microsoft-Intel PC volume and revenue should continue to grow for several years (3-4), then plateau and then decline. Through these phases, gross margins will be maintained at a combined > 70% (Intel Processors are 60% GM and Microsoft O/S is 90% GM). The combination of the two is >70% on a PC. There will be corporate legacy business for tens of years.

Intel has probably war-gamed multiple scenarios on how its business plays out the next 5-10 years. From what we can tell in their initiatives and their actions we know several things are true. One is that they will continue to invest heavily in the data center market because it is their fastest growing processor market with >80% gross margins. Second, it will continue to invest in the mobile market because it cannibalizes desktops and is the nearest competitor to the iPAD and tablets. It fills the fabs to pay the bills now and into the future.

And finally its future is building processors for Apple, Communications chips for Qualcomm and FPGAs for Altera and Xilinx in the most advanced process technology in the world, which in turn will raise the ASPs and margins of its customers. If TSMC can generate 50% gross margins as a broad based foundry, then Intel can generate > 60% (maybe even 70%) gross margins being more than one generation ahead of TSMC and Samsung in process technologies.

Intel’s announcement of a $5B debt offering in September (see Apple Plays Saudi Arabia’s Role in the Semiconductor Market) is preparing them for the conversion from a pure processor play to a near term combined processor vendor and foundry partner for large volume, leading edge customers who themselves also generate 70% Gross Margins (i.e. Apple, Qualcomm, Altera, Xilinx).

ASML- Soft revenues & Orders – But…China 49% – Memory Improving