Asked what it would be spent on, ARM evp Pete Hutton told Electronics Weekly: “Networking, IoT, servers and hiring a lot of engineers – a lot is being spent on software, benchmarking – all the boring plumbing.”

With Qualcomm, AMD, Cavium, Applied Micro and others leading the way in ARM-based SoCs for servers a good chunk of the R&D is being spent on developing server-specific cores. Along with that goes a lot of work to get the software up and running.

“The software is not running on ARM as standard,” said Hutton, “ so we do the porting, do the optimisation and get the feedback.”

ARM seems particularly suited to FD-SOI and last week ARM’s Will Abbey gave a talk in Silicon Valley titled: ‘Realise the potential of FD-SOI in growing markets’. “It’s customer driven”, said Hutton, “we’re getting a bunch of customers – STB people, DTV people, the mid-range mobile people – there’s enough partner interest in it, and people are looking at it and saying ‘we need your help’.

ARM had an interesting Q1 with 16 brand new licensees, 15 of whom were non-mobile applications. What sort of applications? “All over the place,” replied Hutton, “aerospace, IoT, MPU, secure flash – it’s across everything.”

ARM’s Q1 also saw 22 licences signed for Cortex-M – the core for the IoT. Asked about the applications, Hutton replied: “The problem with IoT is that once a product is real, it’s no longer a thing. It’s all about how do we add intelligence to things What we’re doing is putting intelligence into lots of devices – smart watches, storage devices, audio codecs, M2M codecs, inside car communications.”

This year is the year 10nm may emerge. Has ARM got customers making 10nm chips? “Yes,” said Hutton. “How many tape-outs?” “Not saying,” said Hutton. How many customers?” “Not saying, replied Hutton. “Which product areas?” “Not saying,” said Hutton. Still the confirmation is there – 2016 is the year of 10nm.

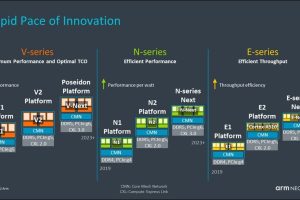

A feature of the Q1 performance was a 10% increase in networking infrastructure shipments. ARM is bullish on networking with an announced aspiration of getting a 45% market share by 2020. It’s a substantial ambition. “We can see the deployments taking place – we’re quite happy with that,” said Hutton, “the major transition is from x86, Power PC, MIPs and a lot of dedicated custom logic towards ARM. We ship to a lot of semiconductor companies who supply end-customers who then tell us how it should be deployed.”.

ARM’s 2015 market shares were over 85% in mobile computers, 60% in wireless connectivity, 25% in microcontrollers, 15% in networking infrastructure, 7% in automotive with 95% in infotainment. Q1 revenues nudged $400 million. Headcount is up 20% y-o-y.

Plumbing is rewarding.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News