The website of China’s National Enterprise Bankruptcy Information Disclosure Platform is asking for investors saying that they must have $7.7 billion in minimum total assets or $3 billion in minimum net assets.

It also says: “The strategic investors should have operational capability and managerial experience in semiconductor and cloud businesses. They must be able to promote the development of our core businesses.”

The deadline for registration is 5 pm on September 5, and investment plans must be submitted before September 25.

In addition, the company requires an upfront deposit of $77 million to Tsinghua Unigroup.

The bankruptcy was initiated by the state-owned Huishang Bank.

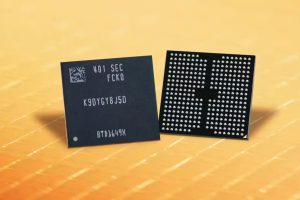

Unigroup has 286 subsidiary companies including Yangtze Memory, Unisoc, New H3C Technologies, Guoxin Micro, and UniCloud Technology.

Although it has assets which could be sold off to pay down the debt, the search for investors is seen as a way to keep the group intact.

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News

Yes Mike it might come as a shock to Xi when he sees that all those gazillions of dosh he’s thrown at Tsinghua have created zero value – except, of course, for Yangtze Memory which may be worth a bit.

Assets : lots of empty fab shells and some memory designs we copied off the Taiwanese.

Absolute bargain ………………. NOT !

Would any investor even be permitted a proper due diligence to check where the IP truly originated from? I am not so sure.

From what one hears the semiconductor is a wild west out there SEPAM, one doubts whether anyone cares, or even knows, where the IP came from.