LEO Satellite Market by Satellite Type (Small, Medium, Large Satellites, and Cubesats), Application (Communication, Earth Observation & Remote Sensing, Scientific Research, Technology), Subsystem, End Use, Frequency and Region - Global Forecast to 2029

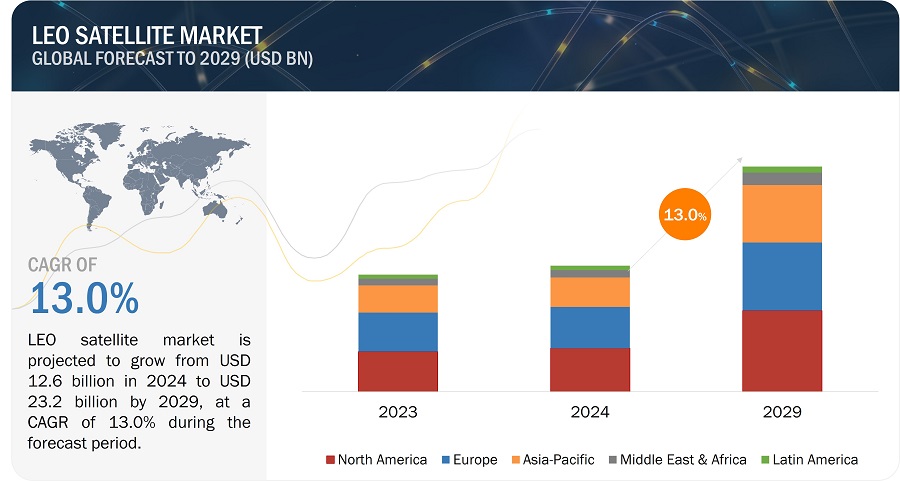

[383Pages Report] The LEO satellite market is projected to grow from USD 12.6 billion in 2023 to USD 23.2 Billion by 2029, at a CAGR of 13.0% from 2023 to 2029. Also, the LEO satellite volume is anticipated to grow from 2,970 units in 2024 to 4,363 units by 2029.

Low Earth orbit (LEO) satellites are satellites designed for low Earth orbit and used for commercial, communication, and space research purposes. According to NASA, a low earth orbit is an earth-centered orbit with an altitude of 2,000 km (1,200 miles) or less. For the purposes of the commercial use policy, a low earth orbit is considered the area in Earth orbit near enough to Earth for convenient transportation, communication, observation, and resupply. Unlike satellites in GEO, which must always orbit along Earth’s equator, LEO satellites do not always have to follow a particular path around Earth in the same way – their plane can be tilted. This means there are more available routes for satellites in LEO, which is one of the reasons why LEO is a very commonly used orbit.

LEO satellites are used for earth observation & remote sensing, communication, mapping & navigation, surveillance & security, meteorology, scientific research & exploration, space observation, and various other applications by the defense, civil, commercial, and government verticals.

LEO Satellite Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

LEO satellite Market Dynamics:

Driver: Rising demand for satellite internet services

There is a growing demand for low-cost, high-speed broadband with increased data transmission capacity for enterprises (retail, banking, energy, mining) and governments in developed and emerging economies. There is also an uplift in demand for low-cost internet service among individual consumers in rural areas, and less developed countries which may not have or limited access to the Internet. Moreover, the eficient internet service and fast speed are driving development of LEO constellation network.

Moreover, increased adoption of technologies like AI, ML, and cloud computing, increased government incentives, limited rural internet access, and the introduction of connected cars and smart cities further boost the demand for satellite-based internet services.

Restraint: Limited coverage and complexity of low earth orbit satellites

A single LEO satellite’s coverage is less, so many satellites must be used to cover the entire area (LEO constellation), while a single GEO satellite is enough to cover the same area. As LEO satellites are constantly moving relative to the Earth, they tend to spend a lot of time over unpopulated areas and oceans, making them ineffective during that time. GEO satellites stay at a specific spot relative to the Earth, and they are more efficient for a smaller, particular area. LEO satellites are less expensive than GEO satellites, but as LEO satellites must be deployed as a constellation, the cost increases. GEO satellites are easier to build and operate than LEO satellites, as there is no need for a real-time antenna tracking service.

Opportunity: Booming 3D printing technology

3D printing has evolved from its early uses in design and prototyping to the production of functioning products. Because 3D printing does not require tooling, unlike traditional manufacturing methods, it can help solve obstacles (such higher tooling costs) associated with traditional manufacturing procedures used for rapid prototyping and small production runs, among other applications. Even if traditional manufacturing might create goods at a lower cost per unit, it would require expensive tooling up front, making low-volume production more costly. By layering components on top of each other, 3D printing technology also contributes to a decrease in waste generated during manufacturing. Another area where 3D printing excels over traditional manufacturing is mass customisation, especially for small batch sizes.

It is still uncertain what parts will be printable using 3D printing and whose production might not be feasible with conventional manufacturing methods. Despite this uncertainty, 3D printing can upgrade supply chain management, which may affect the logistics link between manufacturers and customers for certain types of products or parts. The 3D printing market has also been experiencing advancements in printers and printing technologies, improvement in printing materials, and development in the skill set of the associated workforce.

Challenge: Concerns over increasing space debris

low-Earth orbit (LEO) satellites have the potential to be hazardous to the space environment as they are often launched in densely populated orbits. This is so because low-Earth orbit (LEO) satellites are auxiliary payloads that are launched with more costly and larger spacecraft. They are typically placed next to or alongside other big satellites. These massive satellites are situated in geostationary transfer orbits or sun-synchronous orbits, both of which feature space debris. Microsatellites and nanosatellites are not nimble enough to be able to move around in such orbits. These satellites' native radar signals are usually faint and frequently invisible to space surveillance systems. Moreover, space debris could pose a risk to low-Earth orbit (LEO) satellites, which would increase the quantity of debris from collisions or malfunctions in the systems.

According to Space-Track.org, there are about 14,000 large, medium, and small debris objects floating about in LEO as of May 2023. This is a significant challenge in this field and is under research by various space agencies.

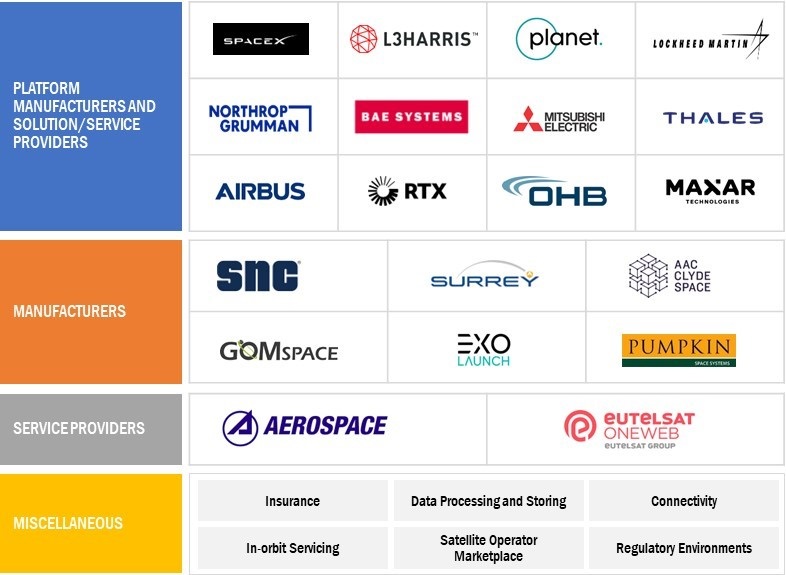

LEO Satellite Market Ecosystem

Based on application, the commercial segment registered largest share in 2023

In terms of application, the LEO satellite market is categorized into five segments: communication, earth observation & remote sensing, scientific research, technology, and others.

The demand for LEO (Low Earth Orbit) satellites for communication applications is increasing primarily due to their capability to provide low-latency, high-speed internet connectivity. LEO satellites, orbiting at altitudes between 500 to 2,000 kilometers, significantly reduce the time it takes for data to travel between the Earth and the satellite. This proximity ensures faster signal transmission, making LEO satellites ideal for real-time applications such as video calls, online gaming, and other services that require rapid response times. The reduced latency is a major advantage over geostationary satellites, which are located much higher at about 35,786 kilometers and thus have higher latency.

Furthermore, LEO satellites can provide widespread coverage, including in remote and rural areas where traditional broadband infrastructure is either too costly or physically impractical to deploy. This capability is essential for achieving global internet coverage and bridging the digital divide. The ability to deploy large constellations of small satellites economically, thanks to advances in satellite miniaturization and cheaper launch costs, allows for comprehensive coverage and network resilience. As a result, telecommunications companies, government agencies, and various industries increasingly rely on LEO satellites to meet the growing demand for reliable, ubiquitous communication services. This shift is underpinned by a growing consumer expectation for constant connectivity, irrespective of geographical location.

Based on frequency, Laser/optical segment is projected to grow at highest CAGR during the forecast period

The LEO satellite market is categorized by frequency into nine segments: Ku-band, Ka-band, X-band, C-band, L-band, S-band, laser/optical, HF/VHF/UHF-band, and Q/V-band. Among these the laser/optical segment is projected to grow at highest CAGR during 2024-2029 due to its high data transfer capability.

Corporations like SpaceX, Facebook, and Google, as well as a series of start-ups, are currently working on various concepts based on laser communication technology. The most promising commercial applications involve interconnecting satellites or high-altitude platforms to build high-performance optical backbone networks. Other applications include transmitting large amounts of data directly from a satellite, aircraft, or UAV to the ground.

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

The LEO satellite market in Asia Pacific has been studied for China, India, Japan, South Korea, and Australia. Asia Pacific countries have been extremely focused on developing advanced technologies for laser- and optics-based satellites. Earth observation and scientific data gathered by nanosatellites and microsatellites support the decision-making process related to climate monitoring and agricultural planning, along with providing inputs related to soil protection in terrestrial and maritime areas and carrying out border surveillance. The growing demand for digital TV and direct-to-home (DTH) entertainment services in Asia Pacific leads to an increasing number of LEO satellites being launched for communication in the region.

LEO Satellite Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the LEO satellite companies are SpaceX (US), Airbus Defence and Space (Germany), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and L3Harris Technologies, Inc. (US). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the LEO satellite market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By Satellite Mass, By Application, By End Use, By Frequency, By Subsystem, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

Companies covered |

SpaceX (US), Airbus Defence and Space (Germany), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and L3Harris Technologies, Inc. (US), and Others |

|

Companies covered (Drone start-ups and LEO satellite ecosystem) |

Pumpkin Inc. (US), Alba Orbital (UK), EnduroSat (Bilgeria) |

LEO Satellite Market Highlights

This research report categorizes the LEO satellite market based on satellite mass, subsystem, end use, application, frequency, and region

|

Segment |

Subsegment |

|

By Satellite Mass |

|

|

By Application |

|

|

By Subsystem |

|

|

By End Use |

|

|

By Frequency |

|

|

By Region |

|

Recent Developments

- In January 2024, L3Harris Technologies, Inc. won a USD 919.0 million worth contract to build 18 infrared space vehicles for the Space Development Agency’s (SDA) (US) Tranche 2 (T2) Tracking Layer program, enhancing missile warning and tracking capabilities. These advanced solutions will aid the US military in countering hypersonic threats. L3Harris’ expertise in space technology and previous work with the SDA further solidifies its position in the defense sector.

- In October 2023, the Space Development Agency (SDA) (US) awarded Northrop Grumman Corporation a contract worth USD 732.0 million to design and build 38 data transport satellites for the Tranche 2 Transport Layer – Alpha (T2TL-Alpha) of the Proliferated Warfighter Space Architecture (PWSA). These low Earth orbit (LEO) satellites will support military missions, with operations scheduled to start in December 2026.

- In October 2023, the US Space Force awarded SpaceX a USD 70 million contract for Starlink internet services. The contract, awarded by the Space Systems Command (US), involves a one-year task order starting on September 1. Additionally, the contract specifies undisclosed requirements set by the US Department of Defense (DoD).

Frequently Asked Questions (FAQs):

What is the current size of the LEO satellite market?

The LEO satellite market is projected to grow from USD 12.6 billion in 2023 to USD 23.2 Billion by 2029, at a CAGR of 13.0% from 2023 to 2029.

Who are the winners in the LEO satellite market?

SpaceX (US), Airbus Defence and Space (Germany), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and L3Harris Technologies, Inc. (US).

What are some of the technological advancements in the market?

- 3D printed satellites manufacturing

- Proliferated leo constellations

What are the factors driving the growth of the market?

- Rising demand for satellite internet services

- Growing need for earth observation imagery and analytics

- Expanding satellite networks for internet access in underserved areas

- Increasing launches of CubeSats

Which region is expected to hold highest market share in the LEO satellite market?

LEO satellite market in the North America region is estimated to hold the largest market share in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

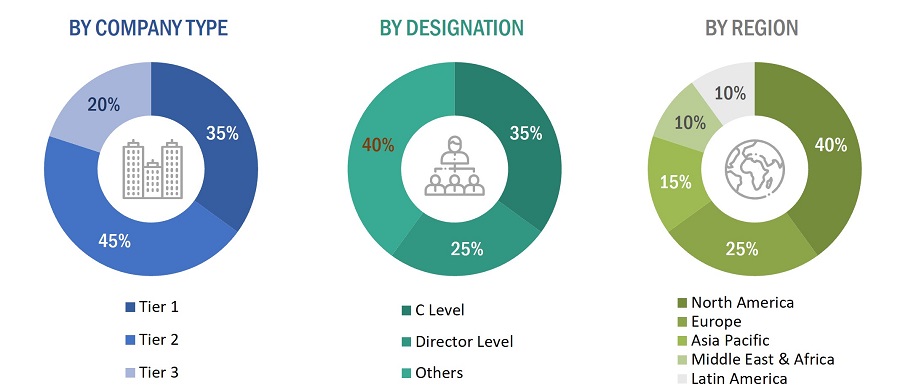

This research study on the LEO satellite market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the LEO satellite market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the LEO satellite market included financial statements of companies offering delivery drone software, drone transportation and logistics services, and transportation and logistics solution providers, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the LEO satellite market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platforms, solutions, technologies, and regions. Stakeholders from the demand side include telecommunication companies, government and defense agencies, broadcasting services, and others who are willing to adopt LEO satellites. These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the market by satellite mass, application, end use, subsystem, and frequency segments of the market for five key regions.

To know about the assumptions considered for the study, download the pdf brochure

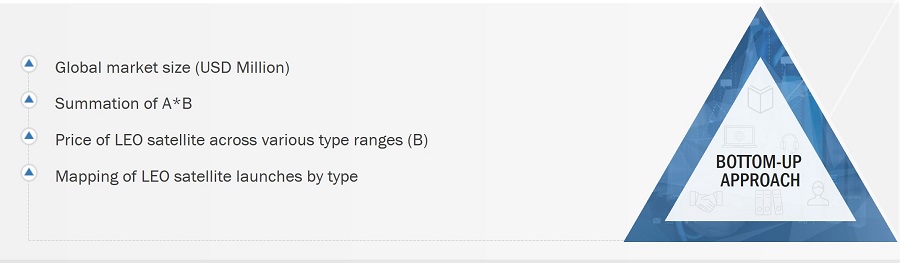

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the LEO satellite market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size of the LEO satellite market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments, data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Low earth orbit (LEO) satellites are satellites designed for low earth orbit and used for commercial, communication, and space research purposes. According to NASA, a low earth orbit is an earth-centered orbit with an altitude of 2,000 km (1,200 miles) or less. For the purposes of the commercial use policy, a low earth orbit is considered the area in earth orbit near enough to earth for convenient transportation, communication, observation, and resupply. Unlike satellites in GEO, which must always orbit along earth’s equator, LEO satellites do not always have to follow a particular path around earth in the same way – their plane can be tilted. This means there are more available routes for satellites in LEO, which is one of the reasons why LEO is a very commonly used orbit.

LEO satellites are used for earth observation & remote sensing, communication, mapping & navigation, surveillance & security, meteorology, scientific research & exploration, space observation, and various other applications by the defense, civil, commercial, and government verticals.

Market Stakeholders:

- Satellite component manufacturers

- Satellite manufacturers

- Satellite integrators

- Launch service providers

- Government and civil organizations related to the market

- Small satellite companies

- Payload suppliers

- Scientific institutions

- Meteorological organizations

- Component suppliers

- Technologists

- R&D staff

Report Objectives

- To define, describe, segment, and forecast the LEO satellite market based on satellite mass, subsystem, end use, application, frequency, and region

- To forecast the market size of each segment of the market with respect to four major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market.

- To provide an overview of the tariff and regulatory landscape in the market across various regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies2.

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new installations & upgrades, investments, contracts, and partnerships, adopted by leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LEO Satellite Market