Robust Growth in Smartphones and Tablets not Able to Offset Decline in Other Segments

Boston, MA - March 27, 2013 - Revenue of the global Consumer Electronics (CE) device industry fell by 2 percent in 2012 to US$729 billion, as the strength in smartphones and tablets were not able to offset broad-based softness in consumer demand for other device segments, according to the latest report from Strategy Analytics, "Connected CE Devices Global Market Forecast."

The Strategy Analytics research discovered that among all regions, the Western European CE market witnessed the worst plunge in 2012, experiencing an 8 percent decline in revenue. The dive in PC sales and lackluster demand for flat panel TVs have mainly caused the market slip, while revenue growth in smartphones, tablets and digital media adaptors was not able to bring the market back above the watermark. Revenue in the Asia Pacific CE market also fell in 2012, particularly as the Japanese TV market suffered from a frightening 68 percent plummet in unit sales in the face of a struggling economic recovery.

"2012 was a very challenging year for many CE device segments, such as flat panel TVs, PCs, games consoles, MP3 players and digital cameras. While we remain cautiously optimistic about the outlook for 2013 as some of these segments are likely to recover, it is hard to find a CE segment beyond smartphones and tablets that have both significant size and rapid growth,†said Jia Wu, Director, Connected Home Devices (CHD).

The report projects that global CE device revenues will grow 6 percent in 2013, thanks to the continued strength in smartphones and tablets as well as a modest rebound from flat panel TVs and games consoles. New form factor convertible PCs may help boost the PC market, as these devices attempt to offer the best of both tablets and conventional PCs.

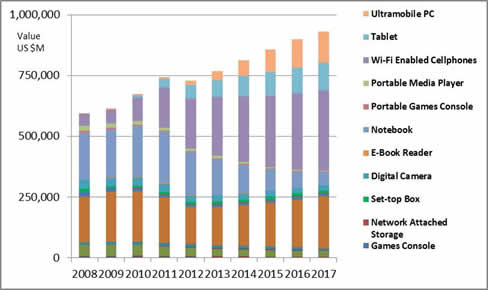

Figure 1 Global Consumer Electronics Device Revenues 2008-2017